Introduction

IBPS stands for Institute of Banking Personnel Selection. It is an autonomous recruitment body established to conduct examinations for hiring staff in public sector banks (PSBs) and other financial institutions in India. Created in 1975, and made an independent entity in 1984, IBPS plays a crucial role in India’s banking recruitment process.

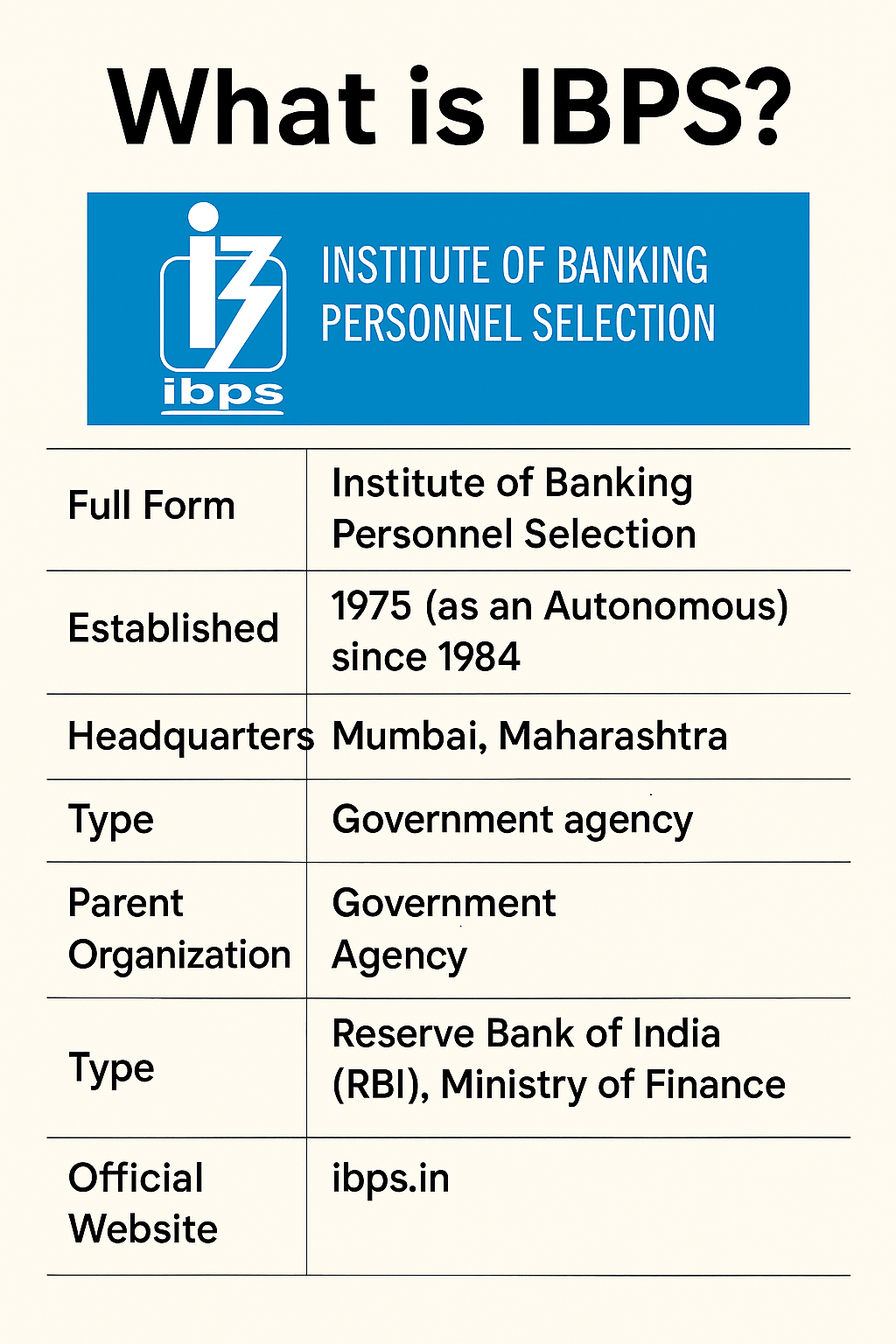

IBPS Overview

| Feature | Details |

|---|---|

| Full Form | Institute of Banking Personnel Selection |

| Established | 1975 (autonomous body since 1984) |

| Headquarters | Mumbai, Maharashtra |

| Parent Organization | Reserve Bank of India (RBI), Ministry of Finance |

| Type | Government Recruitment Agency |

| Official Website | ibps.in |

Purpose and Functions of IBPS

IBPS was set up to standardize the recruitment process for Group ‘A’, ‘B’, ‘C’, and ‘D’ posts in public sector banks (except SBI) and regional rural banks (RRBs). Its core functions include:

- Conducting online examinations

- Designing question papers and evaluation systems

- Holding interviews and group discussions

- Publishing results and provisional allotments

- Creating a fair, transparent, and merit-based recruitment system

IBPS Recruitment Exams List (as of 2025)

IBPS conducts several key exams every year for different banking roles:

1. IBPS PO (Probationary Officer)

- For: Officer-level jobs in PSBs

- Eligibility: Graduate in any discipline

- Stages: Prelims, Mains, Interview

2. IBPS Clerk

- For: Clerical cadre posts in banks

- Eligibility: Graduate

- Stages: Prelims & Mains (No interview)

3. IBPS SO (Specialist Officer)

- For: Technical/Professional roles like IT Officer, Agriculture Officer, Law Officer, HR, and Marketing Officer

- Eligibility: Depends on specialization

- Stages: Prelims, Mains, Interview

IBPS RRB (Regional Rural Banks)

- For: Officer Scale I, II, III and Office Assistants in rural banks

- Eligibility: Graduate (special qualifications for Scale II & III)

- Stages:

- Office Assistant: Prelims & Mains

- Officer Scale I: Prelims, Mains, Interview

- Scale II & III: Single Exam + Interview

Banks Participating Under IBPS

More than 40 public sector and rural banks participate in IBPS recruitment including:

- Punjab National Bank (PNB)

- Bank of Baroda (BoB)

- Canara Bank

- Union Bank of India

- Indian Bank

- Bank of India

- Indian Overseas Bank

- Central Bank of India

- UCO Bank

- All Regional Rural Banks (RRBs)

Note: State Bank of India (SBI) conducts separate recruitment exams and does not fall under IBPS.

Also Read :Happy Doctors Day 2025: Honoring the Heroes in White Coats

IBPS Exam Pattern and Process

Common Recruitment Process (CRP):

IBPS introduced CRP (Common Recruitment Process) to eliminate the need for each bank to conduct its own exams. The process includes:

- Online Registration

- Preliminary Exam (Objective type)

- Mains Exam (Objective + Descriptive)

- Interview Round (for Officer-level)

- Final Merit List & Provisional Allotment

The exams are conducted in multiple languages, including English, Hindi, and regional languages.

IBPS 2025 Calendar (Example Snapshot)

| Exam | Tentative Notification | Prelims | Mains | Final Result |

|---|---|---|---|---|

| IBPS PO | August 2025 | October 2025 | November 2025 | January 2026 |

| IBPS Clerk | July 2025 | September 2025 | October 2025 | December 2025 |

| IBPS SO | November 2025 | December 2025 | January 2026 | March 2026 |

| IBPS RRB | June 2025 | August 2025 | September 2025 | November 2025 |

(Note: Dates may vary. Always check ibps.in for official updates.)

Eligibility Criteria

- Nationality: Indian citizen (or subject of Nepal/Bhutan)

- Age Limit: Usually 20–30 years (varies by post)

- Educational Qualification: Minimum graduate degree; specialized roles may need B.Tech, MBA, Law, Agriculture degrees

Salary & Benefits

| Post | Approx Salary (Monthly) |

|---|---|

| Clerk | ₹30,000 – ₹35,000 |

| PO (Officer) | ₹52,000 – ₹55,000 |

| SO | ₹55,000 – ₹60,000 |

| RRB Officer | ₹50,000+ |

Other perks include DA, HRA, Medical Allowance, PF, Gratuity, and job security.

Coaching & Preparation

Due to its popularity, IBPS exams are highly competitive. Lakhs of students apply each year. To succeed:

- Use mock tests and online practice

- Refer to books by RS Aggarwal, Arihant, and Disha

- Join bank exam coaching if needed

- Focus on reasoning, aptitude, English, GK, and banking awareness

Statistics (Example from Past Year)

- Applicants: Over 90 lakh per year across all exams

- Vacancies: Usually between 10,000 – 20,000 combined

- Success Rate: Less than 2% due to high competition

Conclusion

IBPS has revolutionized the way India recruits banking professionals. With transparent processes, nationwide exams, and fair allotment, IBPS has become a benchmark in public sector recruitment. Whether you aspire to be a bank PO, clerk, or specialist officer, understanding the IBPS system is your first step to a rewarding banking career.